Case study

Hemköp Matkonto

Payment solution with an integrated loyalty model and food budgeting tool for customers of Hemköp

About

Gain a competitive advantage by releasing an open-loop payment card

We’ve launched a new payment experience for the Swedish food retail company Hemköp, enabling customers to earn 25% more membership points when shopping at the Hemköp store and online. Since the card is a debit Mastercard, it works anywhere in the world.

2024

launched in

Hemköp

food retail store

Humla

built and launched by

SEB

financial provider

Opportunity

A unique value proposition

Previously, Hemköp had never offered any kind of payment card linked to customers memberships. But after Axfood acquired our company, Humla, and its payment plattform we built, they saw an opportunity to develop and launch a payment card in-house.

The major competitors could already offer payment cards connected to customer memberships, but the challenge with these was that one card was a credit card, which forced the customer to undergo a credit check, while the other solution was just a regular membership card that could only be used in the competitor’s own stores.

Built on SEB Embedded finance platform

On the embedded finance platform where we had previously developed the Humlakortet, we now saw an opportunity in the market, and for Hemköp, to offer a payment card that works both at Hemköp and worldwide. And unlike a credit card, it’s a regular debit Mastercard where customers pay with their own money and get rewarded for it.

Matkonto is an excellent way for us to reward our most loyal customers. When shopping with the card at Hemköp or Hemköp.se, customers receive 25% more bonus points. On top of that, the app provides a simple way to track grocery spending over time.

Johan Dahl

Head of Business Development, Hemköpskedjan

Built with market leading financial partners and retailers

Overall responsibilities

-

I was responsible for driving the product design work end-to-end, from understanding user needs, business goals, technical constraints, legal compliances, and third-party requirements, to delivering hi-fi design solutions and post-release follow up.

-

Beyond design-related tasks, I was also co-responsible for developing the value proposition and defining the associated business requirements. This included understanding the market, building product vision, time to money strategy, roadmaps, funnels, journeys, flows, WoW, NMS, OKRs, KPIs, among others.

-

Since we worked with several partners and suppliers, including SEB, which provided the embedded finance platform, Axfood and Hemköp for membership integration, as well as Mastercard and Enfuce, which were responsible for issuing the Mastercard card – excellent communication and a high level of collaboration were required.

-

I built the Hemköp Matkonto design system from scratch to enable scalable and consistent implementation of new features, leveraging and extending Hemköp’s core design principles and to stay accessibility compliant.

-

In addition to designing the core Matkonto experience, I also designed the debit Mastercard, created 3D illustrations and mockups, and contributed significantly to refining the marketing materials.

Selected problem statements and HMW

Our generative research highlighted a couple of potential problems

My food money is on the same account as all my other expenses, and I can’t monitor how much is spent

How might we. Help people separate and track their food spending from other expenses to better manage their food budget?

Solution. Matkonto is a separate account to where the customer makes simple deposits with Swish, and therefore isolate the food money and monitoring it through an convenient iOS app.

I don’t want a credit card and undergo a credit assessment, I only pay with money I already have

How might we. Offer solutions that don’t require a credit card or credit assessment for users who prefer to spend their own money?

Solution. Matkonto is a debit Mastercard which means that the customers pay with their own money, and since it’s a Mastercard it works worldwide for all expenses.

It’s a hassle to open a joint bank account today with all paperwork and non-self service processes

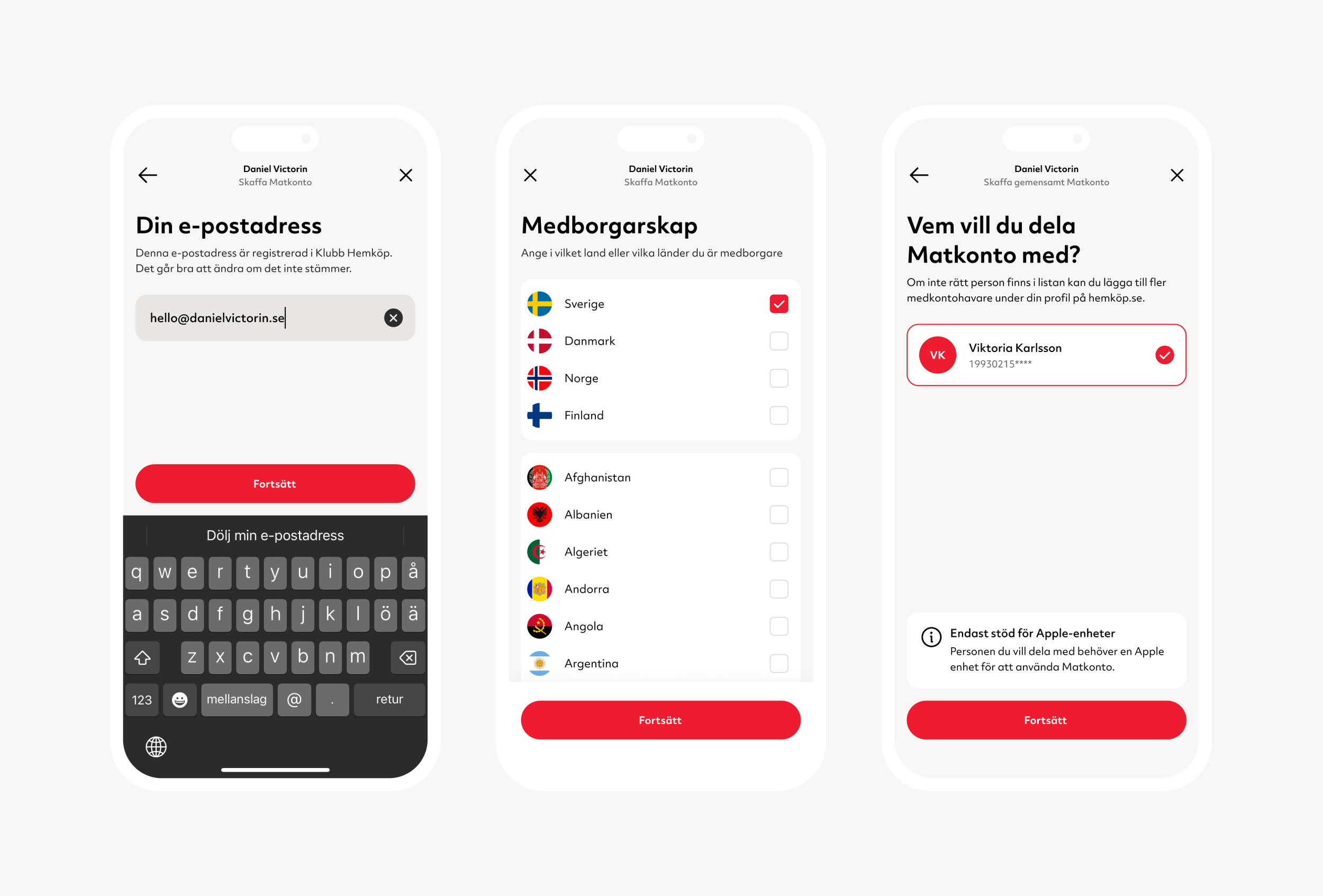

How might we. Make opening a joint account easier and more self-service, reducing paperwork and manual steps?

Solution. Our solution is 100% self-service. When applying for Matkonto the customer can select joint account and then add whoever they want to share the account with. Both users can then access the same account.

I’m a loyal customer who has Hemköp as primary grocery store, but I don’t get enough in return

How might we. Reward the most loyal Hemköp customers in a way that reflects their ongoing commitment to the brand?

Solution. By using Matkonto all customers are eligible for an extra 25% membership points when shopping at Hemköp which will results in higher tier with higher bonuses and more of them.

Target groups

Real value emerges when customer motivations and needs are fully understood

Bargain hunter

Save money, earn benefits, get rewarded

Motivations

Earn more points and bonuses

Get communication on members days

Get updates on points progress

Money mates

Take control and monitor food expenses

Motivations

Earn more points and bonuses

Get communication on members days

Get updates on points progress

Motivations

Control keeper

Take control and monitor joint food expenses

iOS features to follow a food budget

Reactive overview and financial control

Functions to act proactive

SEB Embedded is built on top of SEB’s banking license, which enables us to be a full provider of financial services. We want to design and develop together with innovative partners and look forward to continuing our work with the team at Humla—our first banking-as-a-service customer.

Christoffer Malmer

CFO, and member of the Group Executive Committee, SEB

Lessons learned

Value Proposition and Business Model

The importance of a strong value proposition

No matter how strong the technology or expertise within the team was, it ultimately came down to understanding what the customer truly wanted and building the value proposition around that, since we were launching a product to an already established customer base that had shown loyalty to Hemköp.

Adoption and Scaling

Start small, learn, iterate and scale proposition

We began by conducting generative research to better understand the existing customer base, the challenges they faced, but above all, what kind of loyalty artifacts they were missing. From there, our goal was to release small parts of the experience step by step, in order to build momentum and credibility.

Marketing and Acquisition Funnel

Communicate product in relevant channels

Even though Hemköp already has a customer base of over 2 million, sharp marketing efforts are required to convince loyal customers to commit even further to Hemköp. This is done by promoting the payment service at touchpoints where customers can clearly see the actual value.

Roadmap and Vision

Focus on vision and product breakdown

We created a vision of what we believed Matkonto should stand for. This made it easier to communicate our strategy, goals, and the key metrics we work toward on a daily basis. The vision was built around a product vision board and simple design concepts to clearly illustrate what we aimed to achieve.

We are constantly developing to strengthen our customer offering and simplify the entire customer experience. Now, we are bringing together top expertise in financial services development within the Axfood Group. We look forward to taking further steps in a fast-moving area where new customer value will continue to emerge.

Frida Ridderstolpe

Head of Digital Development & E-Commerce, Axfood

Idea generation and story mapping

A glimpse into our extensive ideation phase and journey mapping

Taxonomy and wireframing

Starting building the app foundation and taxonomy structure

First draft of profile tab taxonomy and self-service features

Onboarding funnel

Mapping every step from first point of contact to first purchase

Metrics and impact

Matkonto delivers proven business value and enhanced customer satisfaction

>50%

of customers downloaded the app also acquired the product

NSM: Number of successful card applications per month

50%

of accounts have ≥ 12 transactions in the last 30 days

NSM: Number of monthly transactions per account

25%

of accounts have 1-11 transactions in the last 30 days

NSM: Number of monthly transactions per account

Key areas of impact

Segment advancement. A higher percentage of Matkonto customers are “full customers” compared to members in general. They move up in tier and increased their rewards.

Higher average receipt value. Matkonto customers have a higher average receipt value prior to using Matkonto, which could mean customers choose Hemköp over competitors in a larger extent.

Higher spend per member. Higher average spend per member compared to their spending prior to using Matkonto, which could mean they choose Hemköp over competitors in a larger extent.

More items per member. Matkonto customers purchase more items per member per month prior to using Matkonto, which could mean more planning when they go shopping.

Solution

Value proposition

Matkonto is among the first debit Mastercards in Europe to offer rewards for spending with your own money

25% more membership points. The customer is rewarded with an extra 25% points when shopping at Hemköp.

Financial insights. Access and get insights on a monthly and yearly basis. Customers with joint account can easy see how much each has deposited e.g.

Joint account. The customers gets one card each connected to same account and together managing their food money.

Pay anywhere in the world. We know that food money is not only used at one specific grocery store, therefore is Matkonto built for all food related expenses.

Food budgeting tool. By deposit the monthly food money the customer can keep track of the budget and expenses until next salary day.

Free of charge first 6 months. Explore the benefits of the product at your own pace. If it’s not for you, you can cancel your Matkonto at any time.

Figma Design System

Built with scalability and modularity to support product growth

Hemköp's basic color is red. It is used in our logo and is the color we are most associated with. But to create a more flexible, yet cohesive expression that also lasts over time, we've expanded our palette with some colors that complement the red well.

Onboarding

It starts with card application

Applying for Matkonto in the iOS app takes just 2 minutes. Customers can then add their card to Apple Wallet and start paying with Apple Pay instantly.

SEB financial KYC integration

iOS self-service application flow for single and joint account

Hemköp membership integration

Enfuce Mastercard personalization production integration

Free of charge first 6 months

Embedded finance

It’s simple, we wanted to offer a financial product without becoming a bank ourselves

SEB provides all necessary banking assets required for us to integrate financial services into non-financial products.

SEB Embedded finance

On top of SEB APIs we focus on building customer experiences throughout the entire funnel to enable the value proposition.

Building the experience

Under the trademark of Hemköp we released the new financial product and payment solution Matkonto.

Launching under a trademark

Financial insights

Designed for monitoring and control

The tool gives customers better control over their food money, how much has been deposited, the distribution between users and what the food money is spent on.

Monthly and yearly data sets for top ups and spendings

Real-time data overview for top ups and spendings

Top up distributions between joint account users

Distribution between purchases at Hemköp and other

Home view widget

Joint account

Built with shared households in mind

Each user get one card connected to same account, no paperwork needed, all self-service. The users can track all transactions made and easily find specific ones by filtering.

Self-service apply for joint account, no paperwork needed

Access same balance and transactions

Financial insights with top up distribution

Shared membership and earn more points faster together

Personal debit Mastercard with support for Apple Pay

Instant deposits and withdrawals

Customer manages balance using Swish app which allows them to do instant deposits and withdrawals. Swish is built on the Swedish central bank payment system RIX-INST that enables money to move in real time between accounts.

Explore something else